Enjoy Premium IPTV in Germany: Cheap Plans for Unlimited Entertainment in 2025

Introduction IPTV in Germany in 2025

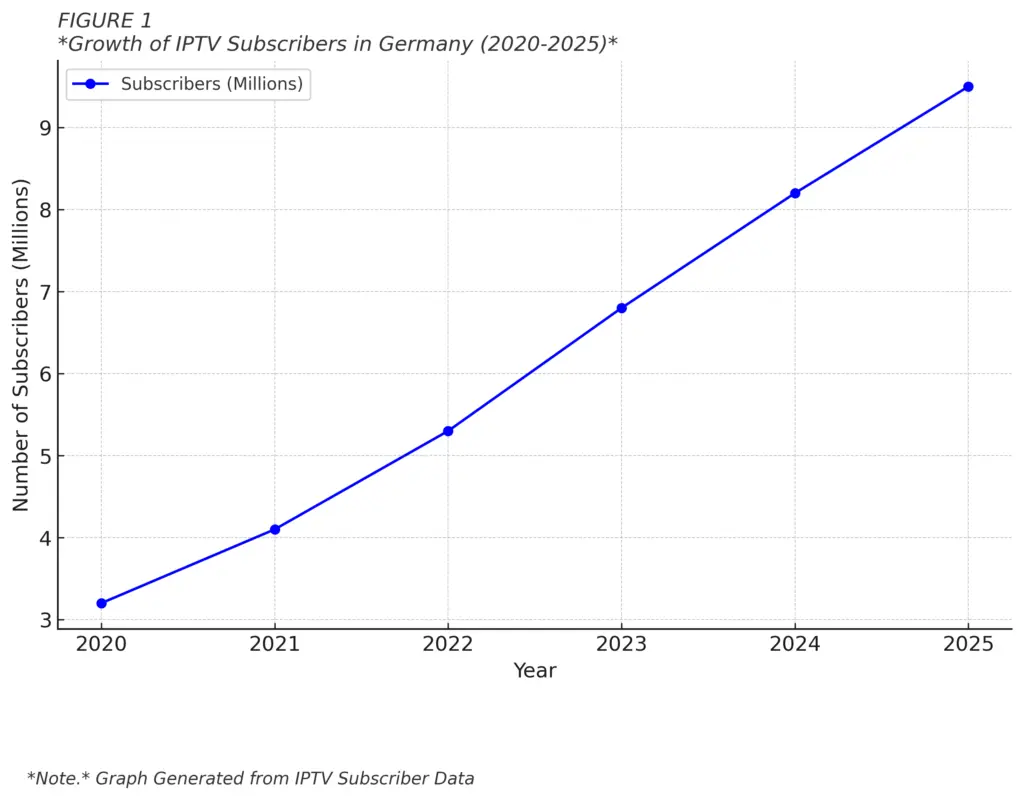

Internet Protocol Television (IPTV) in Germany has revolutionized how Germans consume media content, marking a significant shift from traditional cable and satellite broadcasting systems. As we progress through 2025, the German IPTV market has experienced remarkable growth, driven by increasing internet penetration rates and the growing demand for flexible, on-demand entertainment options. The transformation of viewing habits, accelerated by technological advancements and improved broadband infrastructure, has positioned IPTV in Germany as an attractive alternative for cost-conscious consumers seeking diverse content options.

The German telecommunications landscape has adapted to this evolution, with major providers expanding their IPTV offerings and new players entering the market with competitive packages. This digital transition has been particularly notable in urban areas, where high-speed internet infrastructure supports seamless IPTV streaming services. The accessibility and affordability of IPTV solutions have made them increasingly popular among German households, offering a rich selection of domestic and international content.

(Note. Line graph showing IPTV subscriber growth in Germany from 2020 to 2025, with data points indicating subscriber numbers in millions: 2020 (3.2M), 2021 (4.1M), 2022 (5.3M), 2023 (6.8M), 2024 (8.2M), and projected 2025 (9.5M), demonstrating consistent upward trend in IPTV adoption)

The convergence of traditional television and internet-based services has created a dynamic ecosystem where consumers can access their favorite content across multiple devices, making IPTV an integral part of the modern German entertainment landscape. This shift has changed not only how content is delivered but also how it is consumed, with viewers enjoying greater flexibility and personalization in their viewing experiences.

Current IPTV Landscape in Germany

The IPTV market in Germany has experienced significant growth and transformation in recent years, establishing itself as a crucial component of the country’s digital entertainment ecosystem. As of 2025, IPTV in Germany represents a dynamic intersection of traditional broadcasting and modern streaming technologies, serving millions of households nationwide. The market has grown substantially, particularly in response to changing consumer preferences and technological advancements.

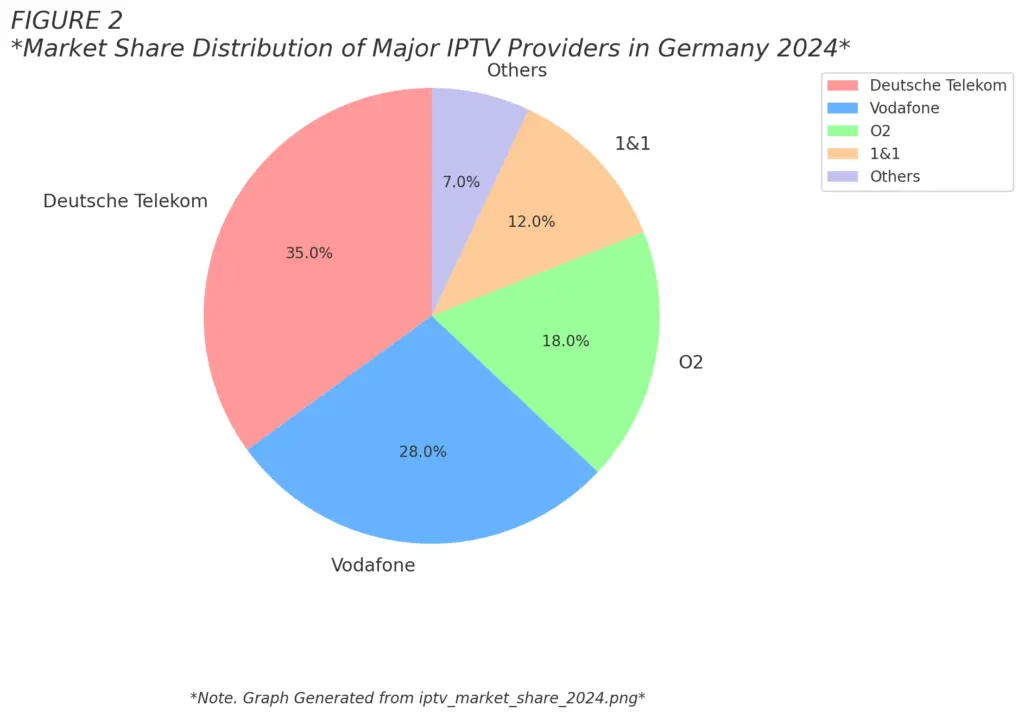

(Note. Pie chart showing market share distribution of major IPTV providers in Germany 2024: Deutsche Telekom (35%), Vodafone (28%), O2 (18%), 1&1 (12%), Others (7%))

This diverse market composition reflects the competitive nature of the German IPTV sector, with each provider striving to differentiate its offerings through unique content, technological innovations, and customer service excellence. The presence of multiple strong players has fostered innovation and improved service quality across the board, benefiting consumers with a wide array of choices and competitive pricing.

Legal Framework and Regulations

The German IPTV market operates under a comprehensive regulatory framework governed by the Telecommunications Act (Telekommunikationsgesetz, TKG) and the State Media Treaty (Medienstaatsvertrag). These regulations establish strict guidelines for service providers, ensuring consumer protection and maintaining broadcasting standards. The legal framework requires IPTV providers to obtain proper licensing from the Federal Network Agency (Bundesnetzagentur) and comply with content distribution rights. Additionally, providers must adhere to data protection regulations under the General Data Protection Regulation (GDPR) and implement appropriate security measures to protect subscriber information. The regulatory environment also mandates transparency in pricing structures and service terms while enforcing strict penalties for non-compliance.

This robust legal framework has played a crucial role in shaping Germany’s trustworthy and reliable IPTV ecosystem. It has protected consumer interests and created a level playing field for service providers, encouraging fair competition and innovation within the bounds of legal and ethical standards.

Major Service Providers

The German IPTV market is dominated by several key players who have established robust infrastructure and comprehensive content offerings. Deutsche Telekom leads the market with its MagentaTV service, providing extensive channel packages and integrated streaming options. Vodafone follows closely with its GigaTV platform, offering competitive packages that combine traditional TV channels with on-demand content. O2 has gained significant market share through its O2 TV & Video service, while 1&1 maintains a strong presence with its IPTV solutions. These providers compete through various strategies, including exclusive content rights, technological innovations, and competitive pricing models.

The market has also seen the emergence of specialized providers catering to specific demographic segments, particularly those seeking international content. Service quality and customer support have become key differentiators as providers strive to retain and expand their subscriber base in an increasingly competitive market. This competitive landscape has driven continuous improvement in service offerings, with providers regularly updating their platforms, developing content libraries, and enhancing user interfaces to meet evolving consumer expectations.

Technical Requirements and Setup

In today’s digital landscape, setting up IPTV in Germany requires careful consideration of technical specifications and hardware requirements to ensure optimal streaming performance. The successful implementation of IPTV services depends significantly on maintaining stable internet connectivity and having compatible devices that can effectively process and display the content.

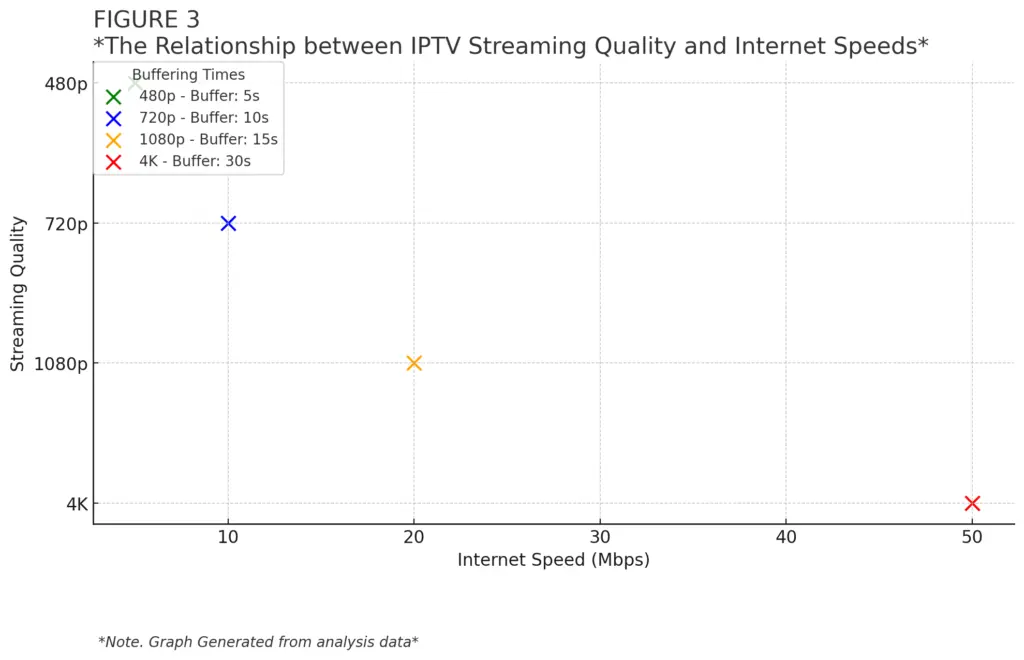

(Note. Scatter plot showing the relationship between streaming quality (480p, 720p, 1080p, 4K) on the y-axis vs. required internet speeds (5-50 Mbps) on the x-axis, with color-coded points indicating buffering times (0-30 seconds), based on typical IPTV streaming data)

This visual representation helps users understand the correlation between internet speeds and streaming quality, guiding them in choosing the appropriate service tier based on their internet capabilities and desired viewing experience.

Internet Requirements

A stable internet connection is essential for reliable IPTV streaming in Germany. The minimum recommended bandwidth for standard definition (SD) content starts at 5 Mbps, while high-definition (HD) content requires at least 10 Mbps for smooth playback. For those seeking premium 4K content, a connection speed of 25 Mbps or higher is necessary to avoid buffering issues. German internet service providers typically offer packages ranging from 16 Mbps to 1 Gbps, making it feasible for most households to access IPTV services. It’s crucial to note that these speeds should be consistent, as fluctuations can significantly impact streaming quality. Users should also consider that multiple simultaneous streams will require proportionally higher bandwidth.

The quality of the internet connection goes beyond mere speed. Factors such as latency, packet loss, and jitter are crucial in determining the overall streaming experience. Many IPTV providers in Germany offer tools or recommend third-party applications for users to test their internet connection’s suitability for different streaming qualities, helping subscribers make informed decisions about their service plans.

Hardware Considerations

The hardware requirements for IPTV in Germany vary depending on the chosen service provider and desired viewing experience. Compatible devices include smart TVs with built-in IPTV capabilities, Android TV boxes, Amazon Fire TV Stick, or dedicated IPTV set-top boxes. Modern smart TVs manufactured after 2018 typically include the necessary software and processing power to handle IPTV streams efficiently. For optimal performance, devices should have at least 2GB of RAM and support H.264/H.265 video codecs. Users can also access IPTV services through smartphones and tablets, though a stable WiFi connection is recommended over mobile data.

When selecting hardware, it’s important to ensure the device supports the required video formats and has sufficient processing power to decode high-quality streams without lag or stuttering. Some IPTV providers in Germany offer their own branded set-top boxes optimized for their services, which can provide a more seamless and integrated viewing experience. However, the flexibility of using third-party devices allows consumers to choose hardware that best fits their overall entertainment setup and budget.

Cost-Effective Solutions

Subscription Comparison

In the evolving landscape of IPTV services in Germany, consumers can access various subscription options that cater to different budgets and viewing preferences. Premium IPTV providers typically offer packages ranging from €10 to €30 per month, with most reliable services averaging around €15 monthly. These subscriptions generally include extensive German domestic channel lineups, international content, and specialized programming. The mid-tier packages, priced between €15-20, represent the sweet spot for most users, offering an optimal balance of content quality and cost-effectiveness. Basic packages starting at €10 monthly usually provide access to essential German channels and limited international content, while premium subscriptions exceeding €25 include additional features such as multi-device support, higher stream quality, and expanded video-on-demand libraries.

When comparing subscriptions, it’s essential to look beyond the price point and consider factors such as content variety, streaming quality, number of simultaneous streams allowed, and additional features like cloud DVR or offline viewing capabilities. Some providers offer flexible plans enabling users to customize their channel lineup, potentially reducing costs by eliminating unwanted content.

To get the most out of all the features, visit the best IPTV in Germany, where we have worked to provide attractive and huge content for both ex-pats in Germany and locals. Where you can find more than 20,000 local and international channels and a huge library of movies and series that meet the growing demand, and all this with a permanent discount of 35 percent, which preserves your budget and gives you access to enjoy what you want

Money-Saving Tips

To maximize value while enjoying IPTV services in Germany, several cost-optimization strategies have proven effective. Long-term subscriptions often come with substantial discounts, with annual plans offering savings of up to 25% compared to monthly payments. Many providers implement referral programs, allowing subscribers to earn credits or free months of service by recommending the platform to others. Family-sharing features in select premium packages enable cost-sharing among multiple households while maintaining separate viewing profiles.

Monitoring seasonal promotions and special offers can also lead to significant savings, as providers frequently introduce competitive deals during major sporting events or holiday seasons. Users should also consider bundled packages that combine IPTV services with other entertainment options, potentially reducing overall entertainment expenses. Regular evaluation of viewing habits helps identify unused features, allowing subscribers to downgrade to more suitable packages without compromising their primary viewing preferences.

Some IPTV providers in Germany offer student discounts or special rates for new customers, which can be leveraged for initial savings. It’s also worth exploring partnerships between IPTV services and mobile carriers, as these collaborations often result in discounted or bundled offerings for existing mobile customers.

Quality Optimization

Several technical factors need to be carefully considered and adjusted to achieve the optimal streaming experience with IPTV in Germany. The foundation of high-quality IPTV streaming begins with a stable internet connection, ideally with a minimum speed of 25 Mbps for HD content and 50 Mbps for 4K streaming. Network stability is crucial in maintaining consistent picture quality and preventing buffering issues. Users should prioritize using a wired ethernet connection over WiFi whenever possible, as this significantly reduces latency and packet loss.

Buffer size adjustment is another critical aspect of quality optimization. Modern IPTV players allow users to fine-tune buffer settings, with recommended values between 2-4 seconds for live content and 5-10 seconds for video-on-demand services. This balancing act between minimal delay and stable playback requires careful consideration of individual network conditions.

Video quality settings should be adjusted based on available bandwidth. While many IPTV services in Germany offer adaptive bitrate streaming, manually selecting the appropriate quality level can prevent unnecessary fluctuations. For optimal performance, users should configure their IPTV player to use hardware acceleration when available, reducing CPU load and improving overall system performance.

DNS optimization can significantly impact streaming quality. German-based DNS servers or specialized streaming DNS services can reduce latency and improve content delivery speeds. Regular maintenance, including clearing cache and updating IPTV applications, ensures optimal performance and prevents common streaming issues that might affect quality.

Advanced users might consider implementing Quality of Service (QoS) settings on their routers to prioritize IPTV traffic over other network activities. This can be particularly beneficial in households with multiple internet-connected devices competing for bandwidth. Additionally, some IPTV providers offer their optimization tools or recommend specific network configurations to enhance the viewing experience for their subscribers.

Frequently Asked Questions

Several key points deserve clarification when addressing the most common queries about IPTV services in Germany. Many users often ask about the legality of IPTV services in Germany. While legal IPTV providers operating with proper licensing and content rights exist, unauthorized streaming services remain illegal under German law. Another frequent question concerns the internet speed requirements for optimal IPTV streaming. A minimum internet connection of 10 Mbps for high-quality HD streaming is recommended, while 4K content typically requires at least 25 Mbps.

Regarding device compatibility, modern IPTV services support a wide range of devices, including smart TVs, smartphones, tablets, and streaming devices like Amazon Fire Stick or Android TV boxes. Users also inquire about channel availability and content quality. Premium IPTV providers in Germany offer extensive channel packages, including local German channels, international broadcasts, and on-demand content.

Service reliability often depends largely on the provider’s infrastructure and your internet connection stability. Payment security is another common concern, and reputable providers offer secure payment gateways and subscription management systems. For technical support, most legitimate IPTV services provide 24/7 customer assistance through various channels, including live chat and email support.

Finally, regarding pricing structures, while costs vary among providers, competitive packages typically range from €10 to €30 monthly, offering different service and content access tiers. Many users also ask about accessing German IPTV services while traveling abroad. Most providers offer some form of international access, though content availability may be limited due to licensing restrictions.

Conclusion

As we look ahead to 2025, IPTV services in Germany continue to evolve and offer increasingly attractive alternatives to traditional cable television. The combination of affordability, extensive content libraries, and improving streaming quality has positioned IPTV as a compelling choice for German viewers. While legal compliance and service reliability challenges persist, technological advancements and growing competition among providers have led to enhanced user experiences and more competitive pricing.

The future of IPTV in Germany appears promising, with expected improvements in content delivery infrastructure and potential regulatory frameworks that could further legitimize these services. As streaming technology advances, German consumers can anticipate even more sophisticated IPTV solutions that balance quality, affordability, and legal compliance.

Integrating artificial intelligence and machine learning algorithms will likely enhance content recommendations and personalization, making IPTV services more tailored to individual preferences. Additionally, the ongoing rollout of 5G networks across Germany is expected further to boost the accessibility and quality of mobile IPTV streaming, potentially opening up new avenues for content consumption on the go.

As the market matures, we may see increased provider consolidation, potentially leading to more comprehensive and integrated entertainment packages. This could include bundled offerings that combine IPTV with other digital services, such as gaming, music streaming, and smart home integration, providing consumers with all-encompassing digital entertainment solutions.

In conclusion, the IPTV landscape in Germany is set for continued growth and innovation. As providers refine their offerings and adapt to evolving consumer needs, IPTV is poised to play an increasingly central role in the German media consumption landscape, offering flexible, high-quality, and cost-effective entertainment options for diverse viewers.